How to Improve Your Credit Score for a VA Loan

MIL-Estate Network is 100% Veteran or Military Spouse Realtors. We have over 140 agents nationwide so we can help you anywhere! A good credit score is essential for securing a VA loan with favorable terms. If your credit score needs improvement, here are steps to boost it and enhance your chances of loan approval.

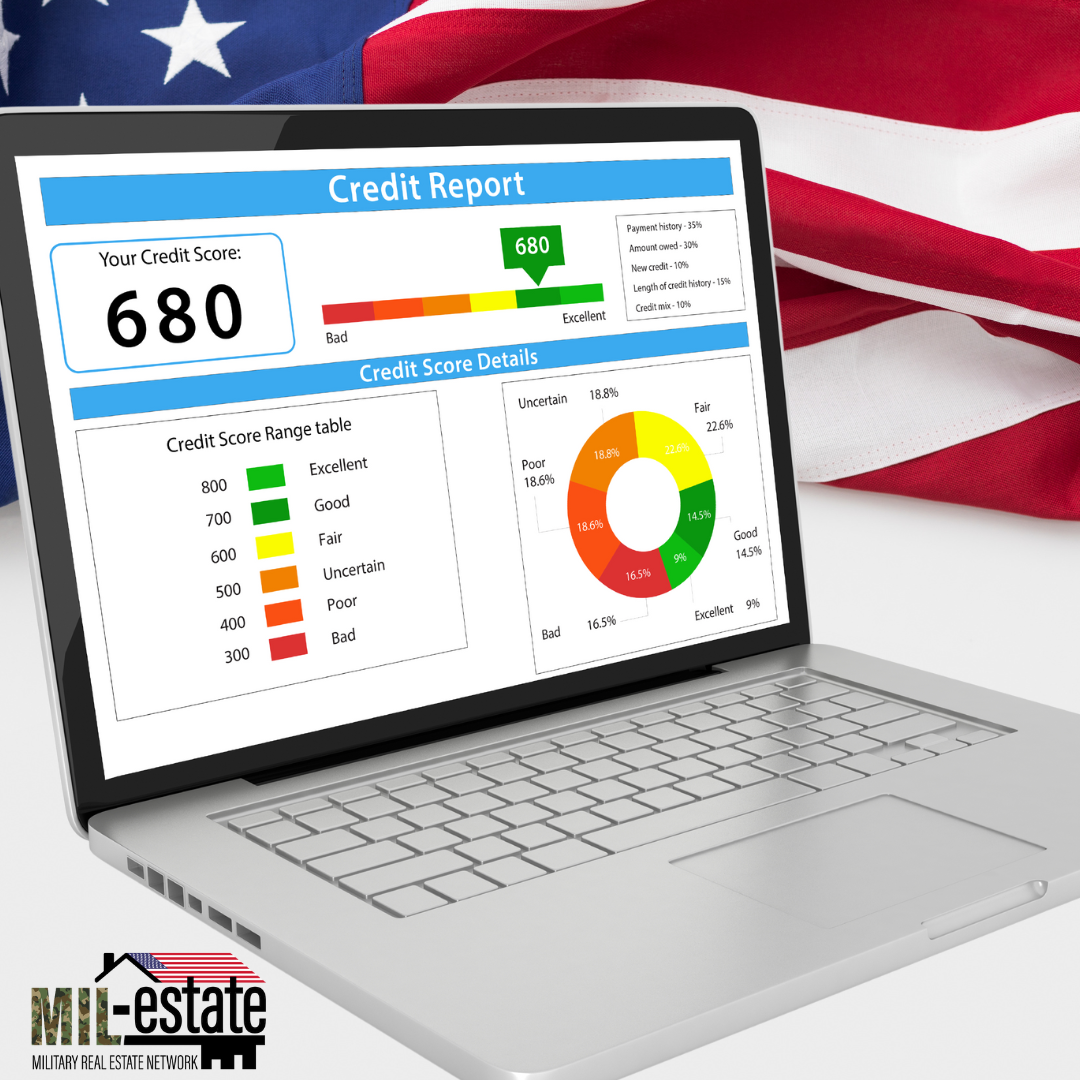

1. Check Your Credit Report

Start by obtaining your credit report from the three major credit bureaus: Experian, Equifax, and TransUnion. Review it for errors or discrepancies and dispute any inaccuracies to have them corrected.

2. Pay Down Debt

High credit card balances can negatively impact your credit score. Focus on paying down existing debt, starting with high-interest accounts. Aim to keep your credit utilization ratio below 30%.

3. Make Timely Payments

Consistently making on-time payments is crucial for a good credit score. Set up automatic payments or reminders to ensure you never miss a due date. Late payments can significantly lower your score.

4. Avoid Opening New Credit Accounts

Each new credit application results in a hard inquiry on your report, which can lower your score. Avoid opening new accounts unless necessary, especially during the loan approval process.

5. Maintain Old Accounts

Length of credit history is an important factor in your credit score. Keep older accounts open, even if you don’t use them frequently. Closing old accounts can shorten your credit history and reduce your score.

6. Diversify Your Credit Mix

A healthy credit mix can positively influence your score. If you only have credit cards, consider adding an installment loan, like an auto loan or personal loan. Ensure you can manage any new debt responsibly.

7. Monitor Your Credit Regularly

Regularly monitoring your credit report helps you stay on top of your financial health. Use free credit monitoring services to track changes and receive alerts about any suspicious activity.

Improving your credit score takes time and discipline, but it’s a critical step in securing a VA loan. By following these tips and maintaining good financial habits, you can boost your credit score and achieve your homeownership goals. If you are relocating anywhere in the country, also reach out to me! I can put you in touch with another MIL-Estate agent anywhere in the country!

Notes from the Lenders: Understanding credit scores can be complex due to the discrepancies between scores provided by different apps and services. Scores from credit card companies or Credit Karma often differ from those used by mortgage lenders, as they employ different FICO models. For a more accurate representation, rely on platforms like myFICO.com, which use the FICO 5 model preferred by mortgage lenders. These scores typically run lower than retail scores, impacting loan terms and eligibility. Addressing fraudulent information on your credit report is crucial, focusing on disputing items with credit bureaus and filing police reports for identity theft. Different types of financing involve varying risk models, with mortgage lenders generally having stricter criteria due to larger loan amounts and longer terms. Understanding your credit profile’s composition is vital, with revolving lines of credit typically considered more important than installment loans.

Keywords: improve credit score, VA loan approval, veteran credit tips, boost credit for VA loan, military home loans

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link